Once a year, we’re all required to pay the tax man, like it or not. I’m sure many of you, like me, start looking for ways we can legally minimize our taxable income. Since I’ve left the corporate world and not longer have a 401k, my retirement account is in a self-directed IRA. So, once a year, I make a contribution to it and pocket the tax savings, by making it a tax-deductible contribution. This works for me, because I assume I can control my income level and ensure that if/when I need to cash that money out, I’ll make sure I’m in a lower tax bracket that I am currently. I also do the same for my spouse, so we get to double-dip, despite the fact that they’ve never worked. Pretty nice!

This results in about $13,000 in reduction of taxable income. This will soon increase, since I’ve reached “a certain age” and will be able to start making “catch up” contributions, although they aren’t strictly necessary for me. So far, nothing shocking, as I assume many of you might do this, if you’re similarly situated.

When it’s tax planning time, many people also start looking at potentially performing some “tax loss harvesting”. If you’re not familiar with this, it basically means you sell some assets that have depreciated, in order to offset some of your taxable income, up to the limits allowed by the tax code.

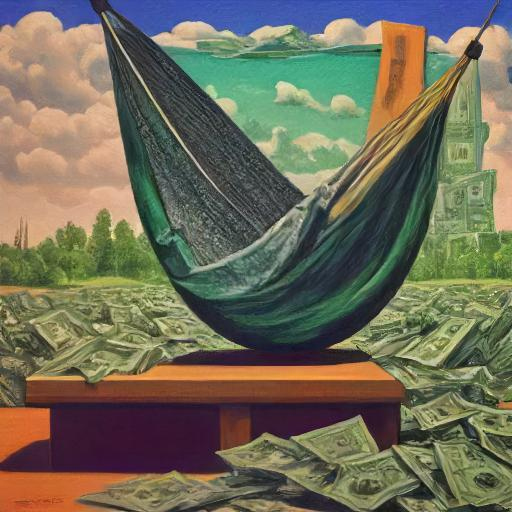

So, it occurred to me, why not combine the two. Basically, every year, I end up selling some assets that have appreciated, along with some that have depreciated. This usually means balancing them out, so that the loss negates the gains, resulting in no net tax, however you could just do it to generate a loss, if that suits your situation better. Then, I move the net proceeds ($13,000) into the IRA. Voila! A free IRA contribution, with no immediate tax consequences.

Due to the “Wash Sale” rules, you can’t claim the loss if you buy back the same stocks (or effectively the same), within 30 days of the sale. So, you can simply due something like sell an ETF and buy back the major holdings of the ETF individually, mirroring the ETF. Alternatively, you could be selling individual stocks and could replace them in the IRA with an ETF that closely matches the ones you sold. You might even be able to simply buy options to bridge the 30 days you’re not holding the original stock, but you’d need to research that yourself. You might even time the sale in a period where you want to take some profits to avoid an anticipated downturn. Either way, once the 30 days passes, you can simply trade back into the original assets and you’re back to where you were originally.

The only constraint is that you, or your spouse has to have earned income in the amount of the contribution, so if you’re not working, you need to have some type of (non-investment) side hustle.

In the end, this seems like a win-win to me. It gives me more flexibility with my assets and in the end I get a tax deduction and tax-deferred future growth.