People often look at retirement planning and calculate the rate of return they expect (or at least hope for), but many don’t stop to think that average rates of return are just that – averages. Many of us wish we could do away with market volatility and just have a nice steady, predictable annual rate of return. Unfortunately, that’s not how markets work. One year you might be up 10% and then down 10% the next. In fact, annual stock market returns are seldom at the average – it’s usually higher or lower.

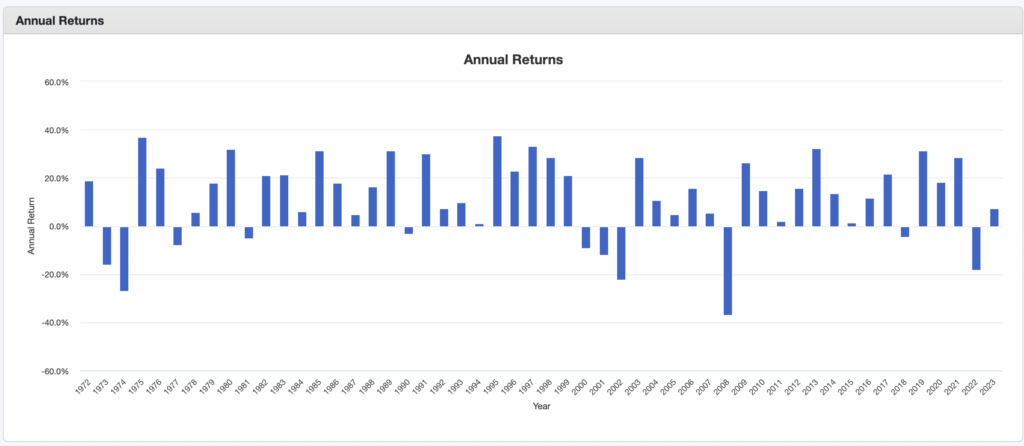

As you can see from the chart below, since 1972, large cap US stocks (i.e., the S&P 500) returns are all over the place year-to-year. The average return over this period is 10.32%, but it was anything but a smooth ride.

Impact of volatility

“Markets can remain irrational longer than you can remain solvent”.

– John Maynard Keynes

Why is this volatility important? Well, if you’re down 10% and you sell $1 worth of stock to buy something, you’re effectively spending $1.10 compared to the previous year. Yes, you’ll also have years when things are cheaper by the same logic. As we’ll see though, the order of those years is critical to your retirement success.

Imagine you plan a 40 year retirement, but you know you’re going to face 10 years that each incur a 20% loss, through combinations of spending and market drops. If you assume all 10 of those losing years occur in your first 10 years of retirement, your portfolio would drop to 80% after year one. Then, within 15 years, you’d basically be broke (less than 4% remaining). Once you’re broke, you’re broke, it doesn’t matter what the market returns are after that.

If however, your first 10 years achieved 10% annual growth (after spending), after that you could lose 20% annually for the next 27 years worth of before you’d go broke.

Visualizing the risk

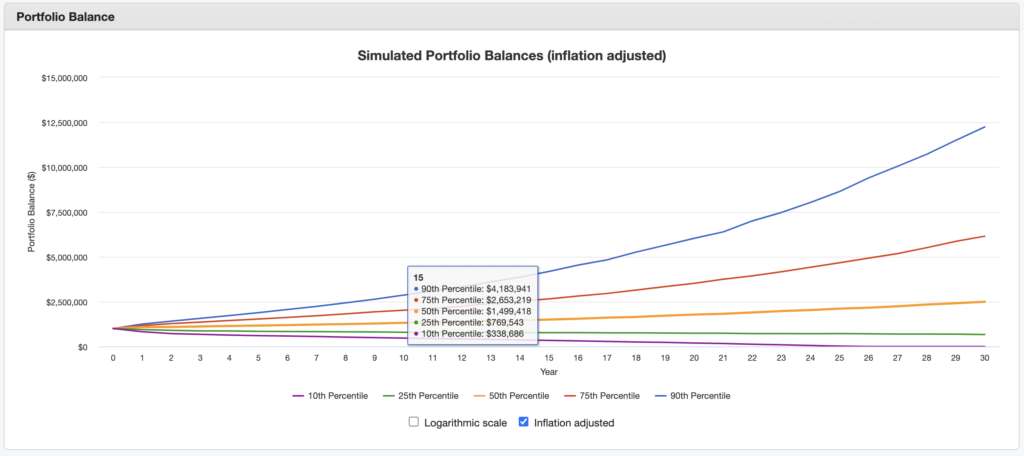

To illustrate this point, we ran a Monte Carlo simulation (a mathematical model to predict outcomes) of a 30 year retirement. In this model, we take out an inflation adjusted 4% annually, from a $1M portfolio. It’s all inflation adjusted. In it you see that in the worst 10% of outcomes, you’d go broke in about 25 years. All the other portfolios survive until the end. In the best 10% of outcomes, you’d die with 10x the money you started with.

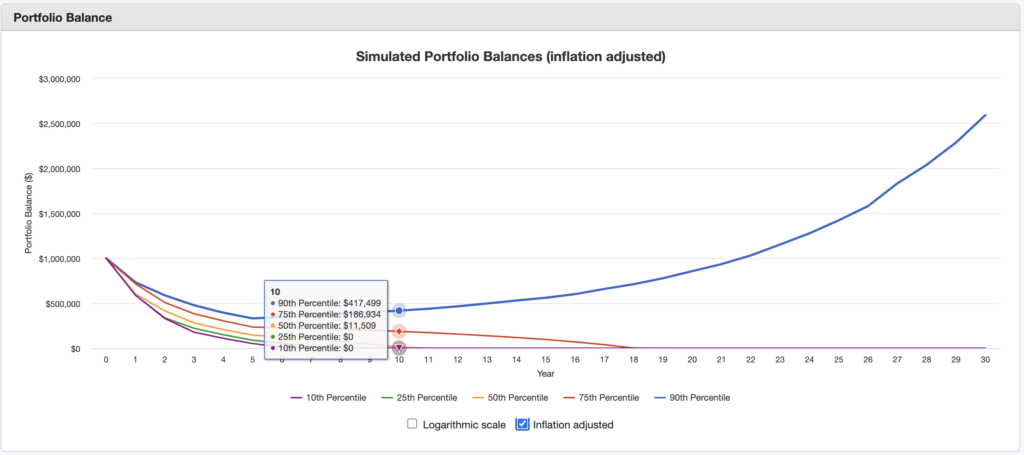

Now, let’s make one small adjustment and put the worst 5 years first. Wow! In this scenario only the top 10% actually lasts until death. Even the best outcomes, the top 10%, only ends with you amassing 2.5X your initial amount (75% less than above). This speaks to the raw power of compounding. It is something you really need to think about when you’re planning your retirement.

In other words, you need to do everything you can to prepare for the first part of your retirement being a disaster. Crushing downturns hurt and unfortunately some people are just unlucky.

What to do?

Here are some strategies that can help:

- Be flexible with spending in the early years

- Delay major spending

- Create additional income

- Reduce outflows prior to retirement (e.g., pay off your mortgage)

- Start with a “soft” retirement – don’t burn bridges

- Only live off the income generated from your portfolio – don’t sell anything

Personally, I embrace the last approach. I generate enough income from my investments to live off of, so I don’t need to sell. I could even suffer a 20% loss of income (not the portfolio value) and not have to make any major sacrifices. Obviously, it still hurts mentally, but this frees me from any immediate concerns with regards to volatility in the portfolio’s value. As long as it is still pumping out the income, I’m happy. Not everyone will have this luxury of course, so perhaps another approach works better for them.

I also still look for opportunities to generate income. You might turn hobbies into income, or do some consulting in your previous field, for example. The main takeaway is to not draw down your assets during a downturn.

We’ll have more related to this topic coming soon, so stay tuned.