Every financial advisor we spoke to in the last couple of years advised us to plan for about 2% inflation when planning for retirement. Anyone familiar with the economy in the late 70’s and early 80’s knows better. The low inflation of the day wasn’t a guarantee. Our own research found that the historical average was closer to 3.22%. We thought this was a safer number to use in planning. Little did we know inflation would take off like a rocket!

If it were only that easy

Many people fail to incorporate the impacts of inflation in their financial plans. It’s what causes us to chase returns beyond just putting our money into a savings account and calling it a day. If it weren’t for inflation, you could just draw up an annual budget and multiply it by your anticipated remaining years of life. You’d be set in terms of knowing if your money will last. As long as the total was less than you had in the bank – great! Otherwise, you’d need to keep going.

Visualizing the impact

As an example, something costing $1 in 1980 would cost about $3.63 in 2023. That’s nearly 4x as much! Historically, as a rough estimate, you should expect prices to triple every 40 years. If you’re 60 and looking and expect to live to 100, you’d want your income to be 3-4x more than today (assuming your spending didn’t change). If you’re younger you’ll need to factor in even more growth of your expenses.

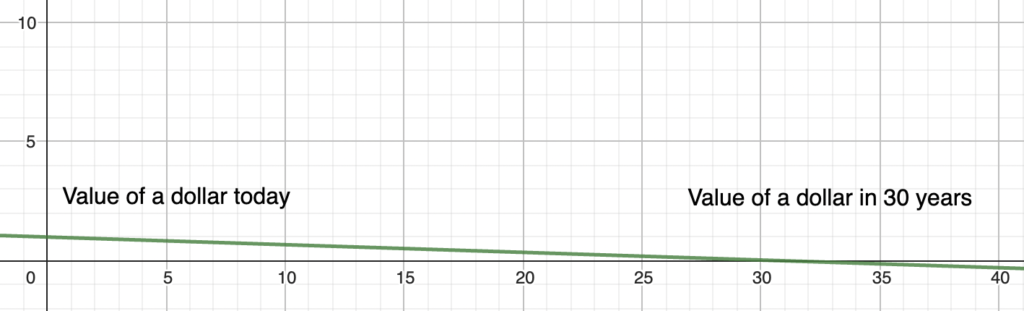

Put another way, with a 3.22% inflation rate, you would expect that any amount of money you have today would be worthless in just over 30 years. Your investments need to make 3.22% just to keep your money’s relative value to be the same. To see this, you can graph y= 1 - x*.0322 where y is the value of a dollar in year x‘s dollars.

When saving is actually losing

Sadly, savings account rates don’t generally meet/exceed the rate of inflation. Realistically, putting your money in a savings account just makes it last longer, but it’s “real” value still deteriorates. If you have enough money to glide until the end of life that’s fine, even with this deterioration unless you plan to leave an inheritance for someone.

With all your investments, you’ll want to beat inflation as a first step. “Real” growth (after subtracting for inflation) comes second. How much growth will depend on the vehicle you select. You’ll then have to determine the amount of risk you’re willing to take on. We’ll dive into that topic in the future.