Have you ever asked yourself whether you should hire a financial advisor? Many people face this question, particularly when planning for retirement. While everyone’s situation is different, let’s take a look at it.

What do they offer?

When I was planning my retirement, I met with multiple advisors. All of them wanted to charge me about 1% of my portfolio (annually) for their services. I hoped these people would blow me away with all their financial wizardry. Surely, they would offer some dark magic secrets to make tons of money with no risk. Sadly, every one of them told me the exact same thing. Allocate 60% to stocks / 40% to bonds, or adjusting a little (e.g., 55%/45%) depending on risk tolerance.

While it might be sound advice, there is no reason to pay a fee for this – especially not on a recurring basis. Any retirement investing guide/web site would basically tell you the same thing. The difference is, those are free. It would be tragic if advisor fees ended up being the thing that kills your retirement fund, while not providing substantive value.

Many advisors had their rebuttals for my clearly disappointed responses. They mostly claimed part of their value was stopping me from panicking and selling in a downturn. I don’t personally think that’s worth an annual 1% of my portfolio. For a $1M portfolio, that would be $10K per year or $833/month – crazy, right?

“We’re on your side”

Many advisors also like to say that they’re motivated to make sure you do well, because they will make more money too. If you lose 20%, they only get 80% of what they got last year. The average advisor has something like $175M in assets under management (AUM), so I’m sure it’s awful for them to get $1.4M rather than the fat $1.75M they got the previous year. Meanwhile, you’re sweating bullets worrying about your future and they literally did nothing tangible for you.

I recently saw a documentary on the book “Freakonomics”. The opening scene described a very similar situation. In that example, a real estate agent was pushing a client to accept an offer $10k less than their asking price. They showed that the agent would only make another $150 (6% – split between agents, then splitting again with the selling agent’s firm). Because of this, they were more incentivized to sell under the value, rather than hold out for a full priced offer. The difference in the agent’s commission was tiny compared to the money lost by the client selling the house. The point being that even when incentives are aligned for two parties, the magnitude and other factors matter as well.

Alternatives

One option these days is to employ a “roboadvisor”. While they are generally cheaper, costing around .25%, they still generally don’t do much more than setting a target allocation (e.g., 60% stocks / 40% bonds). Again, in my opinion, not really worth it. If all you want is a target allocation that adjusts as you near retirement, you could simply buy a target date retirement fund. For example, funds like VTIVX only charge .08%. So, for 92% less than a human advisor, you’d still get the same allocation and not need to manage anything yourself.

An even cheaper options is buying something like the Fidelity Zero funds for the stock allocation, paying nothing in fees. Then find a low-cost bond fund for that allocation. The Vanguard Total Bond Market ETF for example, charges .03%. For a straight forward 60/40 split, you could pay (60 * 0 + 40 *.03%) = .012%, saving yourself quite a bit of money.

Keep calm and let it ride

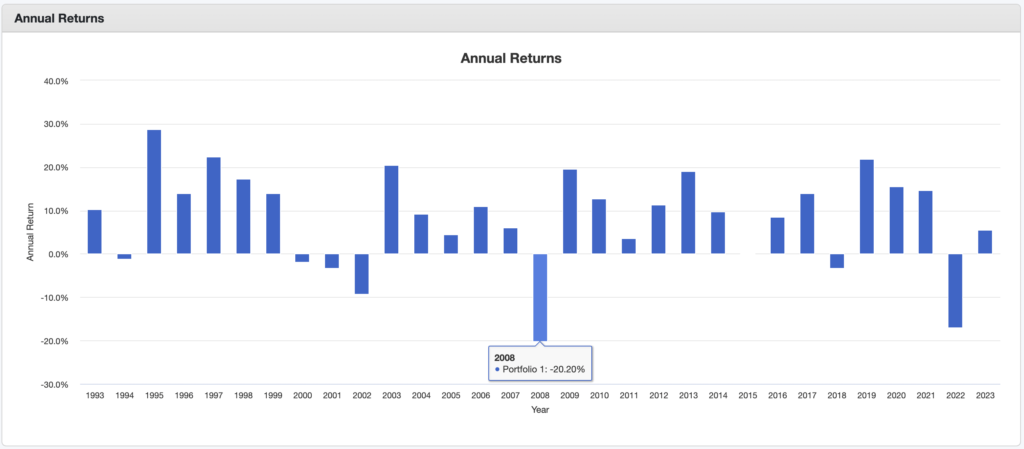

As far as their value to calm you down and not freak out during large downturns, here’s my suggestion. Take a look at the performance of a typical 60/40 portfolio over the last 30 years. Obviously, it’s no guarantee of the future, but what it shows is that for this allocation, even during the height of the financial crisis around 2008, the annual returns were only about 20% down. The peak down point was about 31%.

A takeaway from this is that you should expect numerous years of negative returns , commonly up to 15% losses. My philosophy is that I basically don’t even pay attention until I’ve lost 15-20%. If you think you can sell right before big downturns and buy again before it goes up, you’re probably wrong. There are some tested strategies out there, but you’ll never get it perfect. Not only that, but there are tax implications for selling, unless you hold things in a tax-free account.

The end is near!

You might ask yourself what if we get another Great Depression, or similar event? First of all, that’s why you diversify (stocks, bonds, real estate, gold, etc.). Secondly, if the whole system is collapsing, how much does it matter? If you hypothetically left your money in the bank, how would you know that would even be safe? Even if it was safe, will it retain its value? Will it get eroded by hyperinflation? You just never know.

If you’re still really concerned about risk and your ability to stick it out during a downturn, one strategy you could try is implementing an all weather portfolio. These attempt to cover all the bases (inflation, stock crashes, deflation, etc.). Ultimately, if you want to invest, you have to take on some amount of risk. If you hedged against every possible situation, you’d likely end up with zero growth.

Conclusion

If you have a complicated financial situation, want to ensure your children’s inheritance is setup properly, need to draw up a will, etc., you should definitely talk to a professional. If all you need is to have someone tell you what to invest in and with what allocations, you’re probably not going to see the value of a percentage-based advisor.